How Quantm.One is revolutionizing Home Equity

Find out how Quantm.One’s Equity Freedom works for homeowners

An opportunity to invest in Quantm.One

Quantm.One – our business

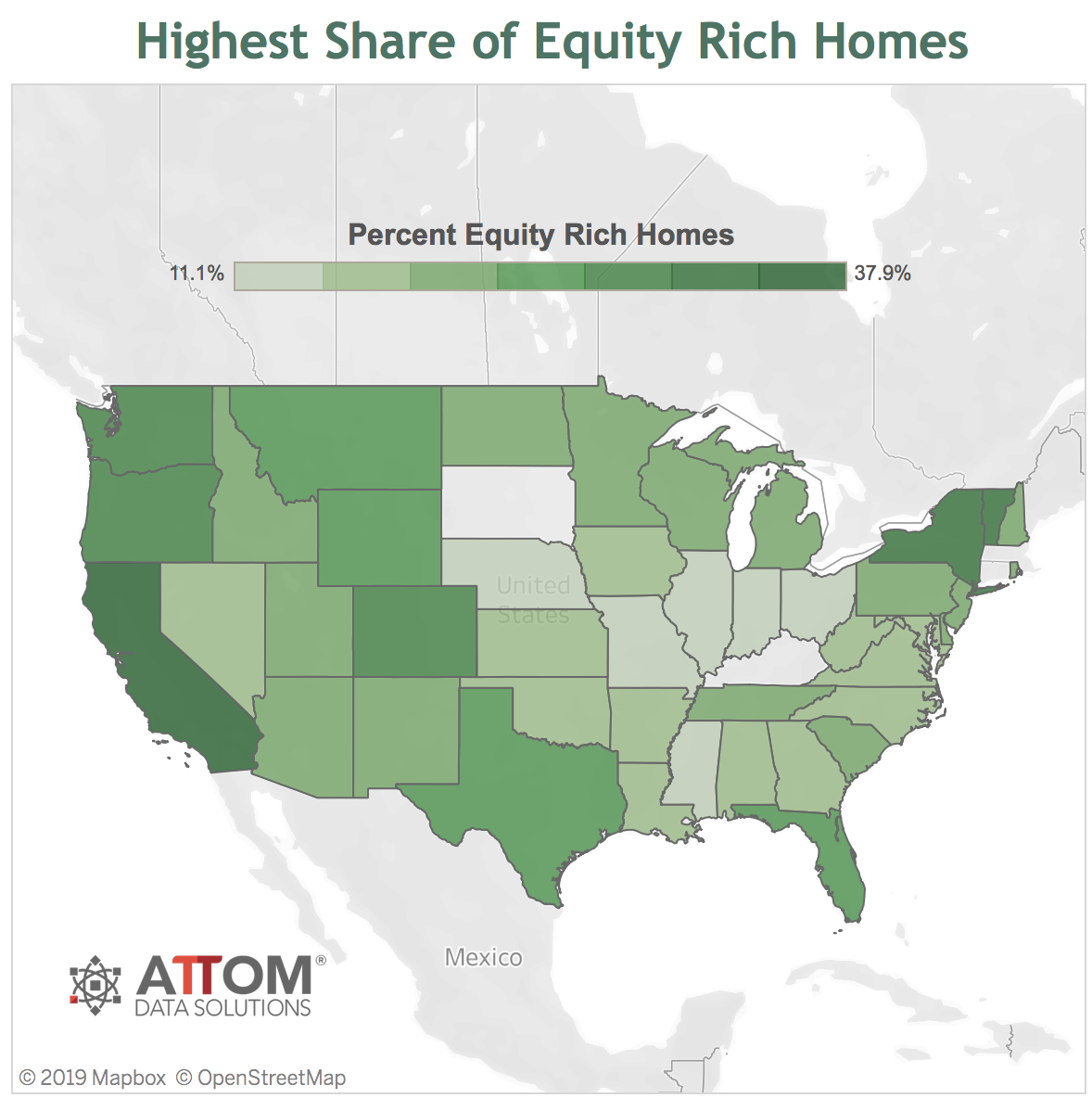

Quantm.One is helping to unlock one of the largest and most concentrated sources of wealth: Home Equity. Residential real estate represents the single largest asset class in the world. In the United States alone there is over $15 Trillion of homeowner equity trapped in residential homes.

The Homeowners’ Dilemma

Home equity is a non-financial asset, which means that it cannot be readily converted to cash or used to purchase goods or services. According to the most recent Survey of Consumer Finances, homeowners over the age of 65 have 73% of their net worth concentrated in home equity. More alarming is the fact that 30% of all homeowners have ZERO net worth outside of the home.

The Investor’s Dilemma

Investors want exposure to residential real estate, but it is difficult to access and has significant burdens. Real estate can have high acquisition, maintenance and disposition fees. Direct ownership requires significant involvement and costs, including managing vacancies, paying taxes and insurance. Generally speaking, conventional real estate investing is capital intensive and does not provide downside protection.

The Equity Freedom Movement has Already Begun

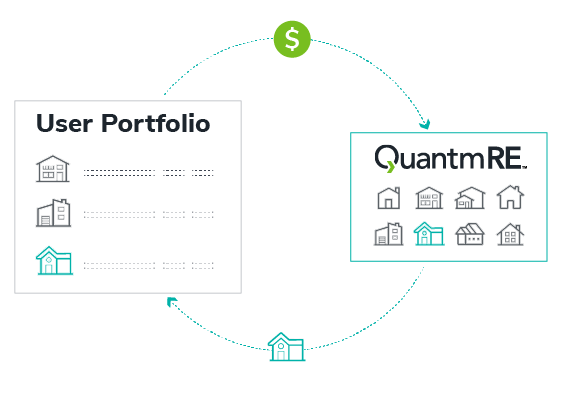

Quantm.One solves these problems. We have created the QuantmRE Equity Freedom Platform – a ground-breaking, patent-pending real estate investment and finance platform that has been designed to give homeowners and investors unprecedented access to the equity in single family homes. We’re solving a major problem for homeowners who want to access the equity in their homes without taking on more debt. We call this Equity Freedom. For investors, we have designed a platform to build, model, manage and trade personalized portfolios of fractionalized real estate investments based on this multi-trillon dollar asset class.

Join the Equity Freedom Movement and invest in Quantm.One

The available market for these solutions is enormous – in the US alone there is over $15 trillion of residential home equity. Quantm.One launched its Equity Freedom Platform as a proof of concept in September 2018 and is now actively working with homeowners who want to get cash by monetizing their home equity without taking out a loan. We are raising additional capital through this Offering so that we can widen our customer and investor base, and to complete the development, build out and regulatory registrations of our unique real estate exchange that has been designed to enable investors to buy, sell and trade equity in single family homes – an asset class that is already seeing explosive growth.

- Quantm.One has been designed to enable institutions and individuals alike to invest in fractionalized owner and non-owner occupied residential real estate

- Quantm.One has been designed to provide potential secondary market trading in fractionalized home equity.

- The Quantm.One platform has been designed to be available to accredited and non-accredited, national and international investors with low initial investment minimums.

Our management team comprises pioneers in the shared equity space who have helped hundreds of homeowners access millions of dollars of equity in their homes. You can bet on our team to innovate, execute and scale Quantm.One. We believe we can revolutionize the way that home equity is accessed, which can both solve a major problem for homeowners and create a potentially tradable real estate asset for investors. Take the opportunity to get in on the ground floor, as we begin to change the way that home equity is accessed across the United States.

– Matthew Sullivan, Founder and CEO

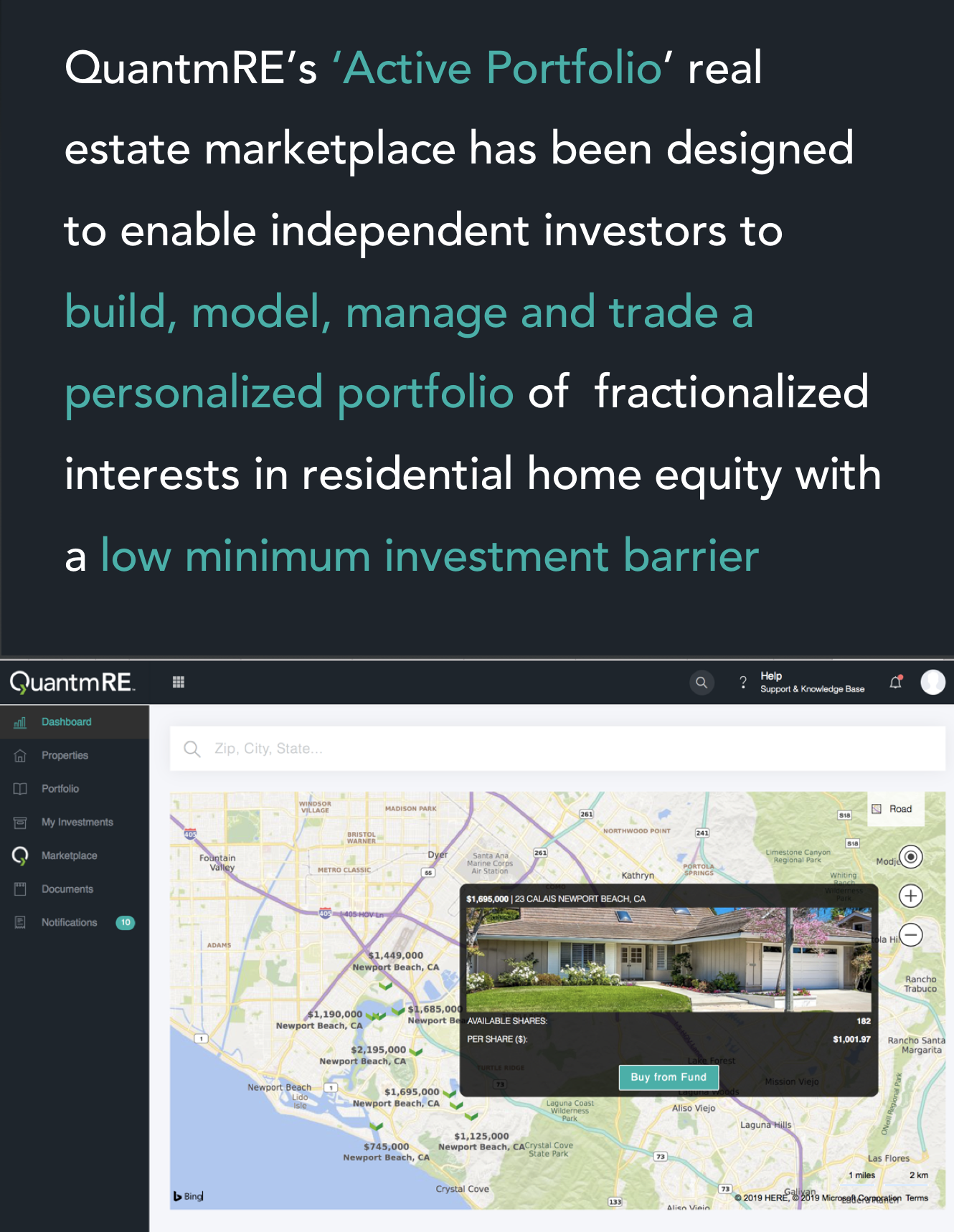

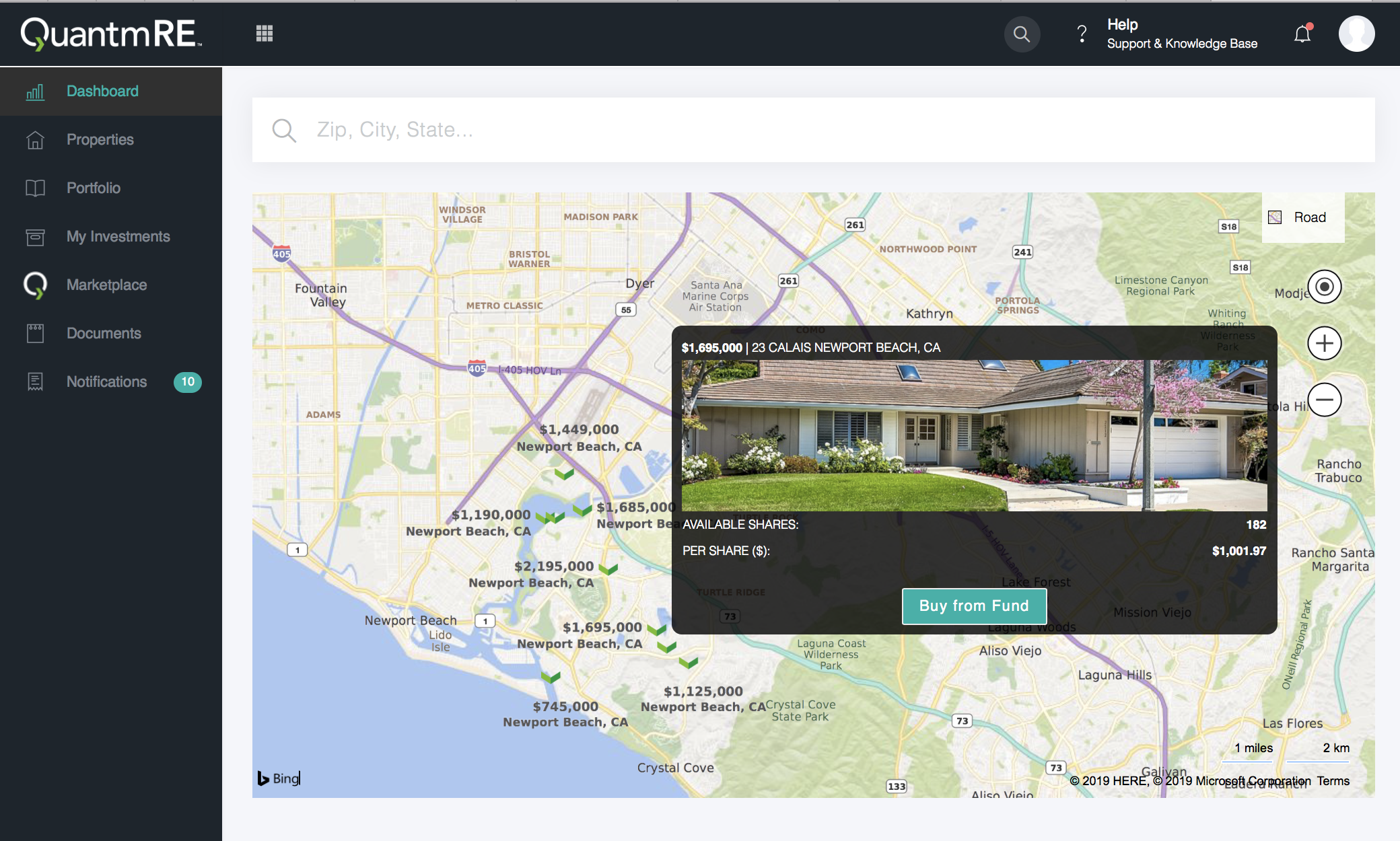

Note: the image above represents a part of the website that is currently under development and is intended for demonstration purposes only.

The Offering

Quantm.One, Inc is offering up to $2,000,000 worth of equity by way of 200,000 shares of Voting Preferred Stock at $10.00 / share

Pre-Money Valuation: $10,336,950

The Company, Quantm.One, Inc, will begin generating revenues in October 2019. We believe the seasoned expertise and experience within the Company’s management team will enable Quantm.One to provide a wider range of products than its competitors, comprising a suite of home equity contracts that can be used by homeowners who are looking for credit repair products as well as a tool for home wealth management. The Company is able to offer a range of customised contracts based on investor demand, which is something we have not yet seen from our competitors. Based on the Company being revenue generating, the marketing impetus it has already created, its channel relationships and its broader market approach, the Company’s management believes its market readiness and ability to compete is greater than that of its competitors when they raised their respective seed capital rounds. This reduces risk of execution and therefore adds value to potential investors.

The $10,336,950 pre-money valuation of the Company is therefore based on the Company’s current status, its market-readiness, reduced risk of execution compared to its competitors when they raised capital at the same stage, the experience of its team, the channel relationships and origination pipeline it has in place, and the comparative valuations of its closest competitors (namely Point and HomeTap) when they were at the same or similar stage in their evolution. No independent or third party valuation has been carried out.

“Quantm.One’s platform has been designed to make home equity accessible, investible and tradable.We’re aiming to solve a major problem for homeowners who want to access the equity in their homes without taking on more debt, while also enabling small investors to invest in residential real estate without the problems of being a landlord”.

Matthew Sullivan, Founder and CEO, Quantm.One

The problems with being House Rich and Cash Poor

Most average Americans have money worries, and they really shouldn’t, because many of them – 14.7 million in fact – also have a very valuable asset that can help with financial liquidity. That asset is the equity in their home. The challenge is that many of these homeowners lack the tools to access the wealth they already own – i.e. their home equity. Traditionally, the only way to access the equity in one’s home was to take on more debt. However, there is another solution. Quantm.One’s Home Equity Contracts can provide homeowners with access to their home equity wealth without taking on more debt, with no interest or additional monthly payments.

For homeowners looking for a way to monetize some of the equity in their home without taking out a loan, Quantm.One’s home equity contracts can enable them to unlock the wealth that’s trapped in their home equity. The big difference is our home equity contracts are not a loan or a reverse mortgage, and that means there’s no added debt, no interest and no monthly payments.

For investors Quantm.One’s Real Estate Investment and Active Portfolio Exchange enables Investors to gain exposure to the equity in prime residential real estate, an untapped, multi-trillion dollar real estate asset class in the US.

Quantm.One’s patent-pending Equity Freedom Platform is designed to enable homeowners to sell, and investors to purchase, a portion of the equity in owner-occupied and non owner-occupied single family residential homes.

Quantm.One – making home equity accessible, investible and tradable.

Watch this video to see how our program works for a homeowner

The Home Equity Contract

At the heart of Quantm.One’s platform is the Home Equity Contract. This agreement allows a homeowner to sell a share of the current and potential future value of their home in exchange for cash now. This is not a tenancy in common. It is not debt. It’s not a line of credit and it’s not a reverse mortgage. The homeowner receives cash, they maintain all their rights and privileges of ownership, and they can settle the agreement by selling their home, refinancing or renewing the contract (all of which may be as long as 30 years in the future).

How will Home Equity Contracts trade on Quantm.One’s Platform?

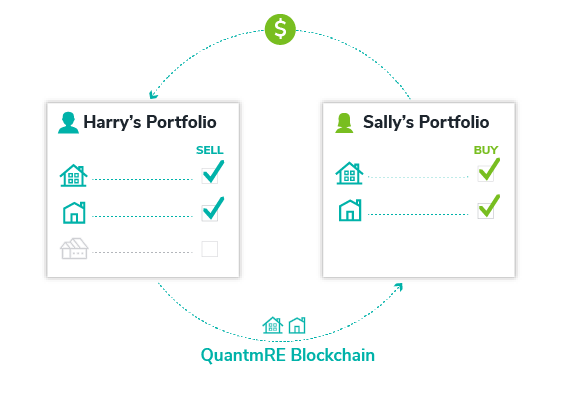

Quantm.One plans to continue the development and build out of its trading platform. Built on blockchain technologies, Quantm.One’s trading platform has been designed to operate like a ‘stock-market’ for fractional interests in residential properties, giving investors a smarter way to invest in US homes. Using the Company’s patent-pending technologies, the economic value of each Home Equity Contract is tokenized and split into $1 shares. These shares can then be offered for sale via Quantm.One’s Active Portfolio exchange so that investors can build a portfolio of their own choice consisting of fractionalized investments in the equity in individual properties. Note: This exchange will require approval from federal and state regulators and non-regulatory bodies, which Quantm.One anticipates could be time and capital extensive. A portion of the proceeds of this Offering will be used for such purpose. If Quantm.One is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Contracts could be limited.

Investors on the Quantm.One platform will potentially be able to purchase fractionalized interests in the home equity contracts of their choice with as little as $100. We will calculate monthly the value of each home equity to reflect the current market value. Investors would then be able to offer their fractionalized interests in these individual contracts for sale on the platform at a price they choose.

The value of each home equity contract will be calculated every month. The Quantm.One platform will update the estimated contract value and how much the contract has appreciated or depreciated over that period. Investors would then be able to set their own price and sell their individual contract interests on the exchange. Investors would pay a transaction fee when they buy or sell their contract interests.

Quantm.One’s Equity Freedom Platform has been designed to enable small investors to get a foot in the door in the residential real estate market with very low investment minimums, and will also allow larger investors and institutions to build targeted portfolios of this unique real estate asset in specific geographies and demographics.

Watch a preview of Quantm.One’s Platform. Note: this video represents a part of the Quantm.One Platform that is currently under development. This video is intended for demonstration purposes only.

How does Quantm.One make money?

Quantm.One has a number of revenue streams. Quantm.One’s exchange platform is a membership-based platform, and we plan to charge investors an annual fee to buy, sell and trade shares in fractionalized home equity contracts (these transactions will be carried out via a licensed broker dealer). We will also receive a fee based on the amount of cash a homeowner unlocks when they complete a home equity contract.

Case studies

In the examples below, traditionally taking on more debt has been the only method of financing available to homeowners. The types of debt can include a conventional mortgage, a home equity line of credit (HELOC) and a reverse mortgage. The problem is that debt is not always the best solution. Debt can be very expensive. In some cases, it can cost much more than the amount that the house has appreciated. The lender takes little risk – their debt is secured against the property. Most importantly, the debt has to be repaid with interest even if the value of the house goes down

There is a better way, though. There is a way for homeowners to gain access to the equity they have built that does not involve debt, interest or monthly payments. The section below features generic examples of real life scenarios describing how unlocking the equity in your home can be used to provide short term solutions, or to implement a longer term financial strategy.

It’s true. You can unlock the equity in your home without taking on more debt

Quantm.One’s Home Equity Contracts

Quantm.One’s Home Equity Contracts enable homeowners to access a portion of the equity in their homes without taking on additional debt. That means no interest, no monthly payments and no restrictions on how the homeowner can spend their money.

- Homeowners can stay in their home for up to 30 years after they have entered into a home equity contract with Quantm.One

- Qualification is simple and flexible

- We look at a number of factors about the homeowner and the home in making an investment decision. We don’t just look at credit score or income

- There are no monthly payments

- Homeowners keep all rights and privilege as a homeowner

- Homeowners get access to a portion of their home equity now without having to sell

- Investors can participate in the appreciation or depreciation of the home value

Quantm.One’s home equity contracts can be a good way for home owners to get immediate value out of their existing equity without the need to take on new debt (i.e., a second loan, HELOC, or reverse mortgage). Homeowners receive cash now in exchange for agreeing to share, with the investor, a portion of the appreciation or depreciation in the value of the property over the length of the agreement.

Homeowners want a debt-free way to access the equity locked up in their home

Investors want exposure to US residential real estate without the cost and involvement of being a landlord

Investors want a platform where they can view, control and manage their investments

Quantm.One’s platform will make home equity accessible, investible and potentially tradable

The Problem – Home Equity

- In the US, there is $15.54 trillion (https://www.statista.com/statistics/375865/value-of-homeownerequity-usa/) of “trapped” home equity

- 7 million homes in the US have greater than 50% in home equity

- Homeowners over 65 have 73% of their net worth concentrated in home equity

- 30% of all Homeowners have ZERO net worth outside of the home

The Solution – Equity Freedom

- At the core of Quantm.One’s Equity Freedom Program is the Home Equity Contract.

- These proprietary contracts entitle the homeowner to access a portion of their home equity wealth.

- The Home Equity Contract is secured by a lien on title

- Allows home equity to be fractionalized and purchased, making home equity accessible, investible and potentially tradable

Home Equity Contracts can be used for:

- Short term credit repair

- Asset diversification, supplement income, college funding

- Home Improvements (e.g. Accessory Dwelling Unit)

- Debt paydown, including mortgage, HELOC payoff

- Medical or health care expenses

Accessible

- The homeowner receives cash

- The homeowner maintains all rights and privileges of wnership The homeowner and the investor share in future appreciation or depreciation of the home

- When the Home Equity Contract ends, the investor receives an equity return based on the appreciation of the home

- Unlike debt, the homeowner’s liability is correlated to value of the home

Investible

- Home Equity Contracts can provide investors with structurally- leveraged real estate returns with downside protection

- For individual investors and institutions, Home Equity Contracts provide a cost-effective, risk-controlled way to get exposure to residential real estate

- One’s platform will give individuals the ability to invest in Home Equity Contracts with a low minimum investment requirement

Note: the image above represents a part of the website that is currently under development and is intended for demonstration purposes only.

Tradable

- The Quantm.One platform has been designed to enable the economic interest in each home equity contract to be fractionalized and split into $1 units.

- These units may then be offered for sale via Quantm.One’s platform.

- The value of each home equity contract will be calculated every month and the Quantm.One platform will show the value of the contract and how much the contract has appreciated or depreciated.

- Investors may set a price and sell their individual fractions on the exchange. NOTE: The Quantm.One real estate exchange will require approval from federal and state regulators and non-regulatory bodies, which Quantm.One anticipates could be time and capital extensive. A portion of the proceeds of this Offering will be used for such purpose. If Quantm.One is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Contracts could be limited.

Our Competitive Advantages

Our team is seasoned and experienced

You can bet on our team to innovate, execute and scale Quantm.One. Our management team is comprised of pioneers in the shared equity space who have helped hundreds of homeowners access millions of dollars of equity in their homes, giving them the freedom to turn their equity into cash and take back control of their finances.

We are making investment in home equity available to retail investors

Our main competitors are Unison, Point and HomeTap who are backed by major venture capital firms, institutional investors, insurance and endowment funds. These investors buy home equity contracts to gain efficient and cost-effective exposure to residential real estate without the costs and friction of physical ownership. Quantm.one is providing this same attractive asset class to individual investors at an investment level that makes sense for homeowners and retail investors alike.

We also compete with other online platforms, such as Fundrise, RealtyMogul, CrowdStreet and other real estate crowdfunding sites who offer real estate investment opportunities to retail investors. We alone, however, are presenting a new opportunity to enhance liquidity in the real estate investing market based on a platform designed to enable members to buy and sell their investments.

Our approach and technologies enables us to offer a number of unique advantages, such as the prospect of a potential secondary market liquidity and the anticipated opportunity to buy and sell fractionalized equity in single family homes via Quantm.One’s unique real estate Active Portfolio Exchange.

- Quantm.One has been designed to enable institutions and individuals alike to invest in fractionalized owner-occupied residential real estate

- Quantm.One has been designed to provide potential secondary market trading in fractionalized home equity

- The Quantm.One platform is being built to give accredited and non-accredited, national and international investors access to investments in prime residential real estate with low initial investment minimums

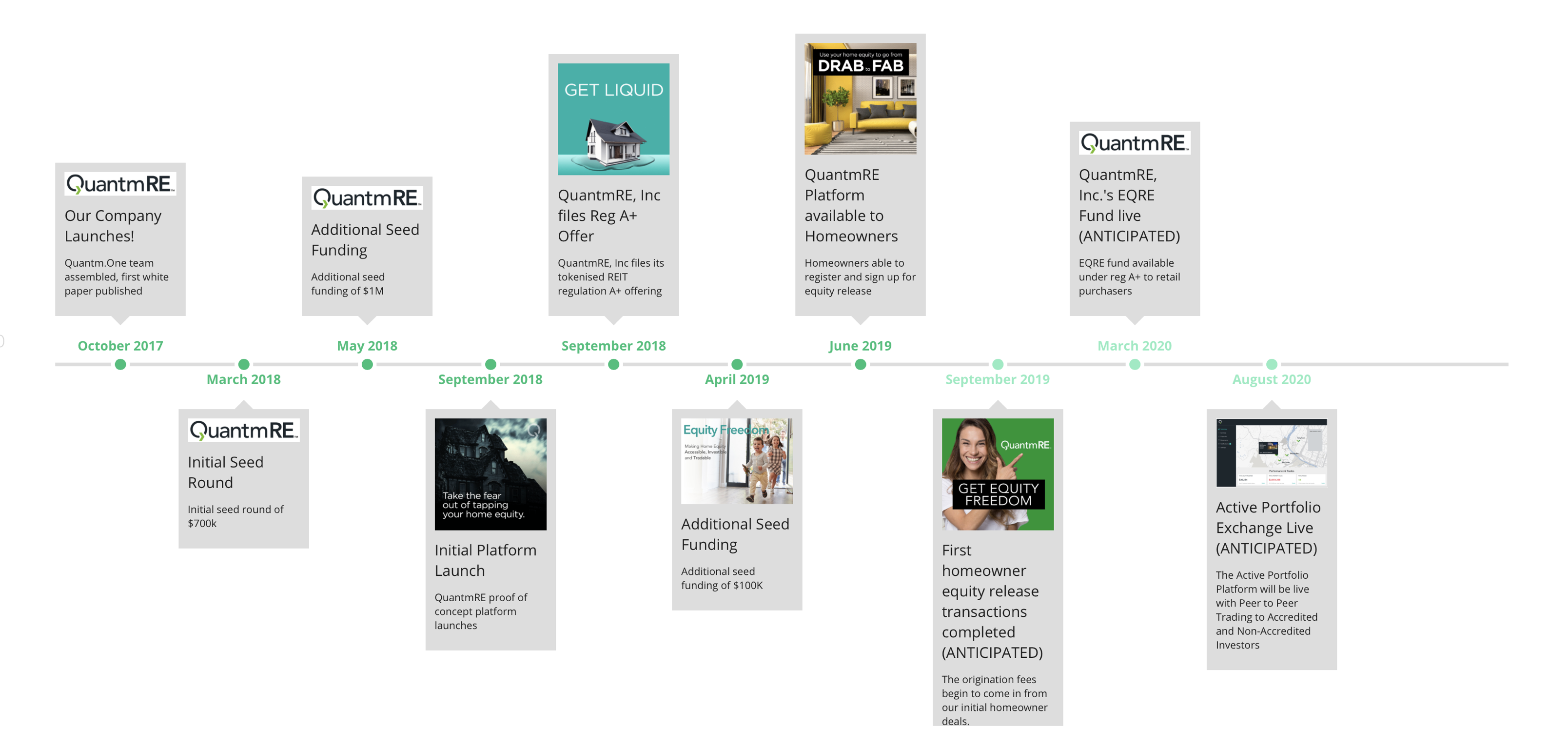

Roadmap

Invest now in Quantm.One, Inc

Join the Equity Freedom Movement and Invest in Quantm.One

Quantm.One, Inc is solving a major problem for homeowners who want to access the equity in their homes without taking on more debt. We are also opening the doors for small investors who want to build, model, manage and potentially trade portfolios of a unique residential real estate asset class that, until now, has only been available to venture capital funds and large institutions. The potential market for both of these solutions is enormous – in the US alone there is over $15 trillion of equity trapped in people’s homes. Our approach has been designed to solve a major personal financial management problem for homeowners, while, at the same time, creating liquidity and tradability for one of the largest asset classes in the country.

We invite you to join the Equity Freedom Movement and become an early shareholder as we revolutionize the way that home equity is accessed in the United States.

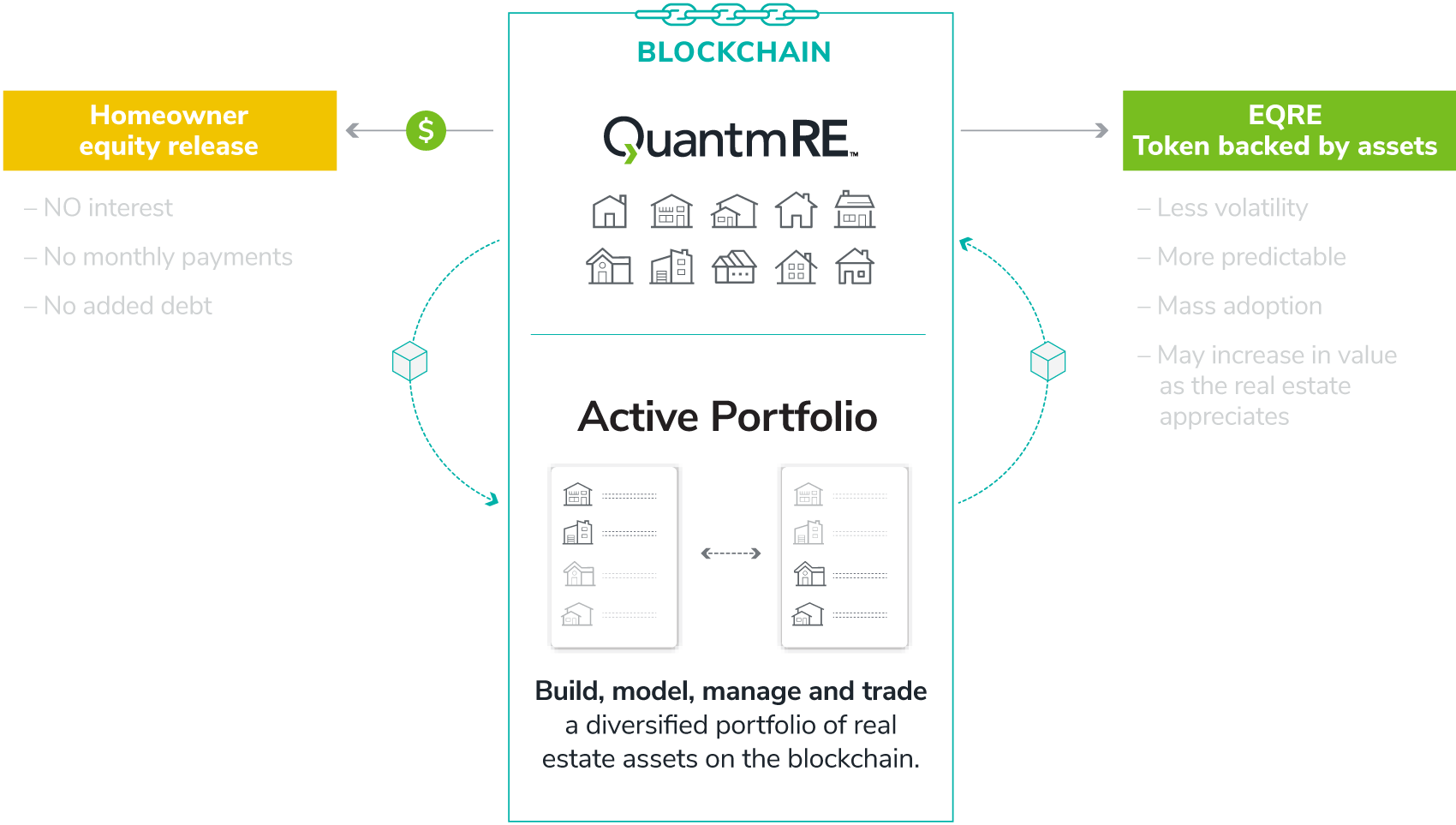

QuantmRE has created ‘EQRE’ – a cryptocurrency securities token tied to a diversified, audited pool of real estate assets.

QuantmRE is building the world’s largest membership-driven, vertically integrated residential real estate marketplace powered by Blockchain technologies, giving investors a unique ability to build, model, manage and trade diversified portfolios of fractionalized real estate assets that have the potential to provide income and capital appreciation.

QuantmRE enables homeowners to release the value of the equity that is locked up in their homes without taking on more debt.

QuantmRE’s patent pending technologies have been designed to make home equity Accessible, Investible and Tradable

Accessible

Homeowners can now access the trapped equity in their homes without taking on more debt.

The Solution

QuantmRE’s Home Equity Contracts enable homeowners to release the ‘dead money’ that is locked up in the equity in their homes without having to take on more debt. For homeowners, that means they can get access to significant amounts of capital with no interest, no monthly payments, and no restrictions on how they spend the money.

Investible

Invest in real estate without the problems of being a landlord

The Solution

QuantmRE’s EQRE fund will enable qualifying investors to make a passive investment in fractionalized equity in single family homes in the US, a previously untapped $15 trillion market

Tradeable

Build, Manage, Model and Trade your own real estate portfolio

The Solution

QuantmRE’s ‘Active Portfolio’ Real Estate Marketplace has been designed to enable independent investors to build, model, manage and trade a personalized portfolio of fractionalized real estate assets with a low minimum investment barrier.

See how QuantmRE works

QuantmRE Membership

QuantmRE’s ‘MQRE’ Membership Tokens can be used to pay for the annual subscription-based services that are offered on the Platform (described below). Membership Tokens, which are separate tokens to EQRE and are not tied to real estate assets, can also be used as a payment method for access to other services offered through Platform.

Membership Tokens retail price

Membership Tokens will be redeemable on the QuantmRE platform for Membership fees. One MQRE Membership token will be redeemable for the equivalent of $1.00 of Membership fees.

Investor

- Purchase EQRE

- Education Programs

- Third party discounts and membership offers

- Market Data

- Build model portfolios

- Payment of fees using tokens

- Personal Active Portfolios

- Early access to new products

- Auto Select Portfolio

- Leaderboard

- Trade multiple portfolios

- API integration

- Sell properties on QuantmRE Marketplace

- Tiered management fees

- Account Management

- Specialized reporting

Active Portfolio

- Purchase EQRE

- Education Programs

- Third party discounts and membership offers

- Market Data

- Build model portfolios

- Payment of fees using tokens

- Personal Active Portfolios

- Early access to new products

- Auto Select Portfolio

- Leaderboard

- Trade multiple portfolios

- API integration

- Sell properties on QuantmRE Marketplace

- Tiered management fees

- Account Management

- Specialized reporting

Enterprise

- Purchase EQRE

- Education Programs

- Third party discounts and membership offers

- Market Data

- Build model portfolios

- Payment of fees using tokens

- Personal Active Portfolios

- Early access to new products

- Auto Select Portfolio

- Leaderboard

- Trade multiple portfolios

- API integration

- Sell properties on QuantmRE Marketplace

- Tiered management fees

- Account Management

- Specialized reporting

QuantmRE is built on trust.

Security

QuantmRE employs the same architecture and cyber security standards as PCI-DSS and enterprise-grade financial institutions. This includes penetration testing as well as cyber security policies in accordance with those standards.

QuantmRE has engaged CybrEye, Inc and Cognitio Corp. to provide leading-edge solutions for security and privacy. The cyber security assessments they will carry out on a regular basis go beyond best-in-class commercial to testing expected in the most sensitive areas of government.

Cognitio Corp. supports QuantmRE through its deep experience in cyber security and enterprise cloud architecture with large government and financial institutions, including investment banks, federally backed student lenders, aerospace companies, big data companies, supercomputing manufacturers, credit unions, and government agencies in the intelligence community.

QuantmRE has been designed around a scalable, secure and distributed third generation Blockchain architecture which will deliver military-grade encryption for transactions, cryptographic anonymity for payments and messages and an environment supporting the creation of investment applications with security and privacy at their core.

Technology

The Active Portfolio Real Estate Marketplace Blockchain has been built using Microsoft.Net and Hyperledger. This Distributed Ledger Technology (DLT) layer represents a small subset of the overall data we collect on assets, owners, and investors. .

Due to the maturity of technology currently available to support an asset-backed token, we will be utilizing public and private Blockchains along with off-chain and sidechain technologies. The public Blockchain will allow us to leverage the power of the cryptographic cyber security capabilities, and our private Blockchain will allow us to operate more freely within our internal/trusted environment.

The QuantmRE infrastructure also uses Amazon AWS infrastructure as a service, the most recent Microsoft.Net Framework as its development language, and best practice project management tools.

QuantmRE Roadmap

The QuantmRe Team

Matthew Sullivan

Founder, Chief Executive Officer

Robert Barr

Chief Financial Officer

Mark Rogers

Sales - Originations

Steve Hotovec

Sales - Originations

Jeremiah Jacquet

Software Engineer

Technical and Operations Team

Bojan Mise

Data Scientist

Dave Sterlitz

Compliance Advisor

Sheila Burns

Director of Strategic Marketing

Heath Jackson Thomas

Creative Director

Marty Tate

Legal Counsel, Advisor

Board of Advisors

David Moss

Senior Blockchain Advisor

Tim Sanders

Advisor

You’ve got questions. We’ve got answers.

In the Press

QuantmRE announces strategic partnership with evNation to provide debt-free financing for solar installations

I’m excited to announce our strategic partnership with California-based evNation. We will now be offering our Home Equity Agreement debt-free financing solution to evNation’s customers, enabling them to maximize their savings and switch to a fully electric life with...

“No loan, no lease: Going solar via home equity agreement” – article about QuantmRE in PV Magazine

Home equity agreements offer a way to purchase solar and EV charging stations without taking on debt or monthly payments. A new partnership between QuantmRE and evNation provides this option. You can read the full article at PV Magazine here.

QuantmRE partners with Texture Capital and Launches Its Blockchain-Based Real Estate Marketplace

Through QuantmRE’s Marketplace investors can buy and sell tokenized interests in the equity in residential homes Newport Beach, California | August 09, 2022 12:30 PM Eastern Daylight Time QuantmRE today announces its partnership with Texture Capital and the launch of...

QuantmRE in the news! 🚀

Matthew Sullivan, QuantmRE's CEO, was quoted extensively in a recent article discussing the growth of Home Equity Agreements, and how they can be an attractive alternative to debt-based options for homeowners looking to unlock a portion of their home’s equity and gain...

QuantmRE Leverages Algorand to Launch a User-Friendly Blockchain-Based, Tokenized Home Equity Real Estate Marketplace

August 17, 2021 10:15 ET NEWPORT BEACH, Calif., Aug. 17, 2021 (GLOBE NEWSWIRE) -- QuantmRE today announced that it will be leveraging the Algorand protocol to deliver a groundbreaking, blockchain-based real estate marketplace that allows investors -- including...

QuantmRE and Revive Join Forces to Offer Debt-Free Financing Solution to Homeowners

NEWPORT BEACH, Calif., Sept. 24, 2020 (GLOBE NEWSWIRE) -- Fast-growing real estate technology startups QuantmRE and Irvine, CA based Agent Angel, LLC dba Revive have announced a partnership to launch an additional business vertical to Revive's customers - Revive Home...

QuantmRE Announces Strategic Partnership With SolArmy To Provide Debt-Free Financing For Solar Installations

NEWPORT BEACH, Calif., Sept. 22, 2020 (GLOBE NEWSWIRE) -- Fast-growing real estate fintech company QuantmRE has formed a strategic partnership with Florida-based SolArmy to provide debt-free financing options to homeowners who wish to add solar panels to their homes...

QuantmRE Takes Aim at Reverse Mortgage Demographic – Reverse Mortgage Daily

Newport Beach, Calif.-based alternative equity tapping company QuantmRE has launched a $1.07 million financing campaign through a crowd-funding platform, and has taken aim at a demographic of potential customers that normally interact with the reverse mortgage product...

QuantmRE Launches $1.07M Crowdfunding Investment Campaign On Republic to Make Home Equity Accessible, Investible and Tradeable

NEWPORT BEACH, Calif., Aug. 04, 2020 (GLOBE NEWSWIRE) -- Real estate fintech platform QuantmRE has launched an investment campaign on the Republic crowdfunding platform with a mission to provide homeowners with debt-free access to their home equity. Read the press...

Alternative Equity Tapping Sees More Interest During Coronavirus – Reverse Mortgage Daily

As more seniors debate additional financial options to make ends meet in order to deal with the economic impact of the COVID-19 coronavirus pandemic, tapping home equity by use of a reverse mortgage seems to have entered into the conversation for many American...

Crypto ETFs: Taking the Long View

Lack of clear regulatory guidelines and the uncertainty it brings has delayed the development of the crypto industry. This is particularly evident when we look at the challenges faced by firms looking to list exchange-traded funds (ETFs) based on the traded price of bitcoin.

Real Estate Security Token “Factor-805” Released, Brings DAI to Digital Securities

It’s commonly been said that the security token sector will first impact the real estate space. After all, we’ve had security tokens represent real estate assets before. Securitize, for example, has been focused on tokenizing some $1 billion of real estate assets; other companies, like QuantmRE are looking to create their own security tokens tied to fractionalized interest in real estate.

STO issuers raise their game in push for regulatory approval

With the SEC promising to issue “plain English” guidance on security token analysis and the industry waiting for the first SEC-approved security token offering (STO), could 2019 be the year that security tokens become the fundraising tool of choice?

How Blockchain Technology Will Improve Securities Markets

Much of the attention the blockchain and cryptocurrency markets received in 2017 and 2018 has waned as Bitcoin’s price has fallen about 75% from its peak. One area within the space that is growing in favor despite the broader negativity is securitized tokens.

Interview Series – Matthew Sullivan, CEO of QuantmRE, Inc

Matthew Sullivan, CEO and Founder of QuantmRE, talks about how QuantmRE’s EQRE securities tokens and the blockchain are re-imaging the way houses are financed. Interview with Antione Tardif, CEO of BlockVentures.com, as part of Securities.io’s interview series.

For digital asset exchanges, regulation will be good for business

Digital asset exchanges that use blockchain technology are looking at regulation as the next step to market growth. There are a number of exchanges that are developing their technologies to enable traditional assets such as bonds, venture capital, real estate and art to be tokenized and traded in a way that is compliant with local securities regulations.

Why blockchain will drive the real-estate revolution

Advances in blockchain innovation mean that the real estate sector no longer needs to rely on dusty documents and traditional sales processes, because property titles, insurance, ownership transfer and escrow processes are all moving onto the blockchain.

STOs: the natural evolution of ICOs

The tokenization of assets and securities and the creation of regulated trading exchanges built on the Blockchain will have a significant impact on the securities market, delivering a quantum leap in speed, efficiency and cost reduction. Think of it in terms of the impact that the internet and email had on the world of traditional communications.

QuantmRe Launches Security Token Backed by Property Assets

QuantmRe, which operates a blockchain-based real estate trading platform, announced on Tuesday the launch of the EQRE security token, which allows qualified investors to get exposure to fractional equity interests that focus on US residential properties.

QuantmRE To Hold STO for Security Tokens Tied to Fractionalized Interest in Real Estate

Through a partnership with Prime Trust, QuantmRE, a blockchain-based platform for real estate, has announced that they will be holding their own security token offering. The token will be reflective of fractional property ownership in the real estate market.

From the Blog

Why ADUs Might Be an Excellent Investment Option for Homeowners

Thinking about adding on to your home? Whether you’re looking to create a rentable space to attract a tenant, or you’re planning for the care of an aging relative who needs a bit of help, but wants to retain a degree of independence, ADUs might be the best option. Not sure what an ADU might be, why you would want to invest in one, or how any of this works? Let’s break it down for you.

The Problem With Cryptocurrencies Having No Intrinsic Value

One of the reasons that many people are still on the fence when it comes to choosing to use cryptocurrencies is because this type of currency does not have any intrinsic value. The intrinsic value, sometimes called the inherent value or the true value, is the perceived value of something including the tangible and the intangible factors.

Why Stablecoins Are Critical for the Mass Market Adoption of Cryptos

Cryptocurrency has been around for less than a decade at this point, and while there are a quite a few people who have invested in these digital currencies, it is still not a mainstream form of investment. Stablecoins could help change that, offering a huge benefit to those who are looking to make investments and stable trades in cryptocurrencies.

Will the Future Stock Market Be Tokenized?

The world is still waiting for cryptocurrencies to become more mainstream than they already are. One of the ways that this is likely to happen is through asset based tokens. If and when this occurs, it is going to influence the stock market and other areas of finance in a massive way.

Will Blockchain Technology Make Refinancing a Home Simpler?

Refinancing a home can be just as problematic as obtaining an initial home mortgage in the first place. There’s good news, though. Blockchain technology might be able to make refinancing a home simpler, cheaper and faster. Here’s what you should know?

What is a Stablecoin?

Have you heard of the term stablecoin? They have gained in popularity over the course of the last year or so, but there are still many who are not entirely sure what these coins are or why they are important. Here’s what you need to know.

There’s No Such Thing as Good Debt

Don’t fall into the trap of thinking a mortgage or student loans are “good debt”. The truth of the matter is that there is no such thing as good debt, no matter what anyone tells you. Those who use the term and believe in it are either mistaken or trying to find ways that they can justify the amount that they have spent.

Why Wealth Managers and Family Offices Should Get Serious About Tokenization

Wealth managers should take a closer look at tokenization, in particular tokens that are tied to residential real estate. Combining tokens and real estate brings a whole new perspective to property investment. For family offices and wealth managers it is an ideal solution because it bridges the gap between digital and real assets.

QuantmRE Moves Towards Full Compliance

Matthew Sullivan, CEO and Founder of QuantmRE, the world’s first Blockchain-based real estate network which offers fractional interests in single-family residential homes, has put strict governance at the heart of his business. He believes that best-in-class compliance should be at the top of every token issuer’s agenda.

The Future of Security Tokens

Security tokens are likely going to have a very bright future. Those who are considering making investments, whether they are large investors such as an institutional investor or they are a single traditional investor, will find the idea of these tokens very intriguing.

The Hottest Areas of California Real Estate Aren’t What You Think

Thinking about adding to your real estate portfolio? Real estate investing is still tremendously profitable in the Golden State. The hottest areas for California real estate investing probably aren’t what you think. These are the best bets for your portfolio.

Why asset-backed tokens could be a better investment than REITS or rentals

Asset-backed tokens offer a broader range of investments to choose from and can create an extra layer of diversification in real estate investing. Investors looking for innovative ways to increase returns are embracing the introduction of asset-backed real estate tokens.

Asset-backed tokens: the game changer for real estate investing

By tokenizing assets and putting them on the blockchain, the broader investing public will have access to a variety of real estate investment products as well as the potential to reap higher returns.

How Blockchain Will Affect Home Financing: A Homebuyer’s Guide

Homebuyers should know that blockchain technology has already disrupted multiple financial sectors, and it promises to do even more, affecting segments like securities settlement, global payments, debt issuance and the home mortgage industry.

Real Estate Moving to the Blockchain

The blockchain makes buying real estate easier, faster and safer – executing and recording contracts, deeds, escrow, and other financial transactions within the distributed, secure blockchain environment.

California Real Estate Trends: Watch Market Movements to Make Smart Decisions

California real estate prices are at record highs. You should know all the market trends before buying or selling, and how fractional ownership can help create opportunities in real estate investing.

Institutional Investors Begin to See the Value in Asset-Backed Tokens

Investors are more and more excited about asset-based tokens because of the advantages that they can offer. In addition to the stability compared to cryptocurrency Coins, Tokens offer liquidity and can open up investment opportunities in a wide array of assets.

How Blockchain Can Democratize Real Estate Investing

It is not easy for everyone to make investments in real estate. In some cases, the inability to buy real estate might be due to finances. Even those who have the money to make an investment may not be able to invest for one reason or another depending on where they live. If someone hopes

Blockchain Technology: Understanding How It Works

Unless you’ve been living under that proverbial rock, you’ve at least heard about blockchain technology. It’s the tech that underpins cryptocurrencies like bitcoin and ether. However, there’s a lot more to understand about this technology, how it works, and the benefits that it has to offer.

Stay in the know – join our mail list.

QuantmRE won’t share your information with anyone.